Discover all the programs to stop foreclosure, including last minute ways to stop foreclosure in your state.

Are you facing foreclosure and searching for creative ways to stop the foreclosure and keep control of your home? In this article, we'll provide you with common and uncommon ways people stop the foreclosure process. From negotiating with your lender to seeking assistance from government programs, there are several avenues you can explore. Additionally, we'll highlight common scams that target individuals in such situations and offer tips on how to avoid falling victim to foreclosure scams.

Additionally, foreclosures have a detrimental impact on the mental health of individuals and their children, with 91% of foreclosure studies conducted by the National Library of Medicine, confirming its negative effects. The stress and emotional turmoil of losing one's home often leads to adverse health behaviors, poorer overall health, and can indirectly affect entire communities.

By arming yourself with knowledge and understanding your rights, you can take steps towards finding a solution to protect your home and metal wellbeing.

If you find yourself in a situation where you can no longer afford your home and need to sell, we'll guide you on how to navigate the process and ensure you avoid giving away your home to an investor or paying unnecessary fees.

Whether you're looking to save or sell your home, get ready to discover common and unique approaches that may offer solutions you never thought possible for your home.

Programs To Stop Foreclosure - Ways to Prevent Foreclosure and Keep Your Home.

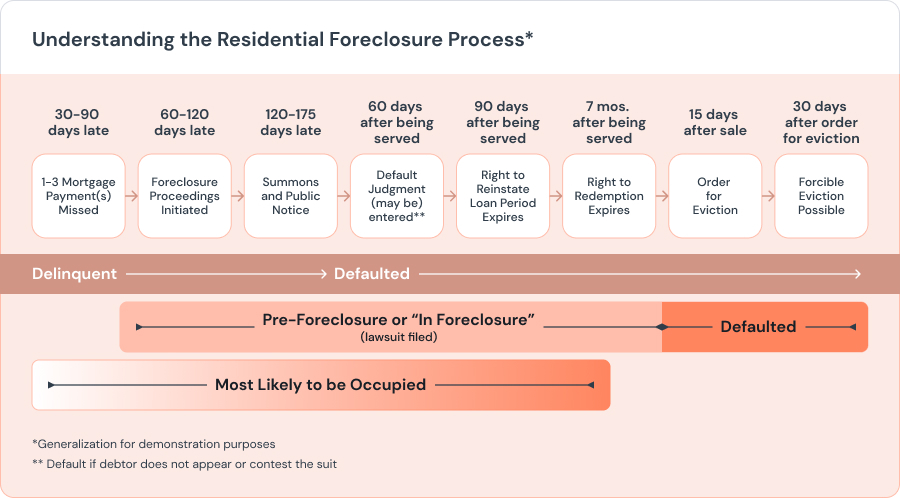

Foreclosure is a process in which a lender seizes and sells a property due to the homeowner's inability to make mortgage payments. If you're facing the daunting prospect of foreclosure, rest assured that there are multiple options worth considering to help you stop it. Some of these options include exploring a home loan modification possibilities, refinancing your mortgage, seeking assistance through government programs, negotiating one of many Loan forbearance options, pursuing a short sale, engaging in a deed in lieu of foreclosure, working with a housing counselor, applying for a loan reinstatement, consider a loan assumption, or exploring the potential for bankruptcy. In the following sections, we'll delve into each of these options, providing you with valuable insights to help you navigate through this challenging situation.

Most Common Ways to Stop Foreclosure:

- Communicate with your lender: If you find yourself unable to make mortgage payments, it is crucial to contact your lender as soon as possible. By initiating communication and informing them about your financial difficulties, you give them an opportunity to work with you on a solution. It is important not to wait until you are already behind on payments before taking action. Promptly addressing the situation can increase the likelihood of finding a mutually beneficial plan to avoid foreclosure. Explaining your circumstances and demonstrating a willingness to resolve the issue can open up possibilities for loan modifications, repayment plans, or other alternatives.

- Get help from foreclosure housing counselors and programs: Government programs and housing counselors can provide valuable assistance and guidance when it comes to preventing foreclosure. The Making Home Affordable (MHA) program, for example, offers free counseling services for individuals struggling to pay their mortgages. By calling the provided hotline, you can access professional advice and support tailored to your situation. Additionally, HUD-approved housing counseling agencies can offer local foreclosure prevention services, helping you explore various options available in your area. It is crucial to leverage these resources to understand your rights, available programs, and potential solutions.

- Last-minute ways to stop foreclosure: If you are facing an imminent foreclosure, there are some last-minute strategies you can consider. Filing for bankruptcy is one option that can immediately halt the foreclosure process through an automatic stay. Chapter 13 bankruptcy may allow you to restructure your debts and potentially save your home, while Chapter 7 bankruptcy can provide temporary relief and delay the foreclosure. Another option is to file a lawsuit against the foreclosing party if there are valid grounds to challenge the foreclosure, such as errors in the process or violations of state laws. It is essential to consult with legal professionals to understand the implications and viability of these strategies in your specific circumstances.

- Ask the servicer to postpone the sale: Although servicers are typically reluctant to reschedule foreclosure sales, it doesn't hurt to ask if you are facing an imminent sale. While not guaranteed, some lenders may consider a postponement if presented with a compelling reason or a valid plan to resolve the delinquency. It is important to approach the situation with a clear and feasible proposal, demonstrating your commitment to rectifying the situation and keeping your home. While this option may not always be successful, it is worth exploring and discussing with your lender.

- Apply for a Home Loan modification: If you have fallen behind on your mortgage payments, applying for a loan modification can be a viable option to avoid foreclosure. This process involves negotiating with your lender to modify the terms of your loan to make it more affordable based on your current financial situation. A loan modification can involve lowering the interest rate, extending the loan term, or even reducing the principal balance. By demonstrating your ability to make modified payments, you can potentially secure a new agreement that allows you to stay in your home while avoiding foreclosure.

- Apply for help from your state's Homeowner Assistance Fund program: There are many programs to stop foreclosure such as the Homeowner Assistance Fund. This fund was established under the American Rescue Plan Act, aims to provide financial support to households facing mortgage payment difficulties due to the COVID-19 pandemic. While this program may not directly halt a foreclosure, it can provide crucial assistance in catching up on missed payments and resolving the underlying financial challenges. Each state has its own Homeowner Assistance Fund program, and by applying for help, you may receive financial aid to alleviate the burden and prevent further delinquency.

- Loan forbearance options or mortgage modification: Several options exist for homeowners who are at risk of foreclosure. Reinstatement involves making a lump sum payment to cover the overdue mortgage payments and any associated fees before a specified deadline. A short refinance involves negotiating with the lender to forgive a portion of the debt and create a new